On February 28, the United States Supreme Court heard arguments for two upcoming cases against President Joe Biden’s student loan forgiveness program. The Supreme Court’s ultraconservative majority, which has already overturned abortion rights and environmental protections, seems poised to rule against student loan forgiveness.

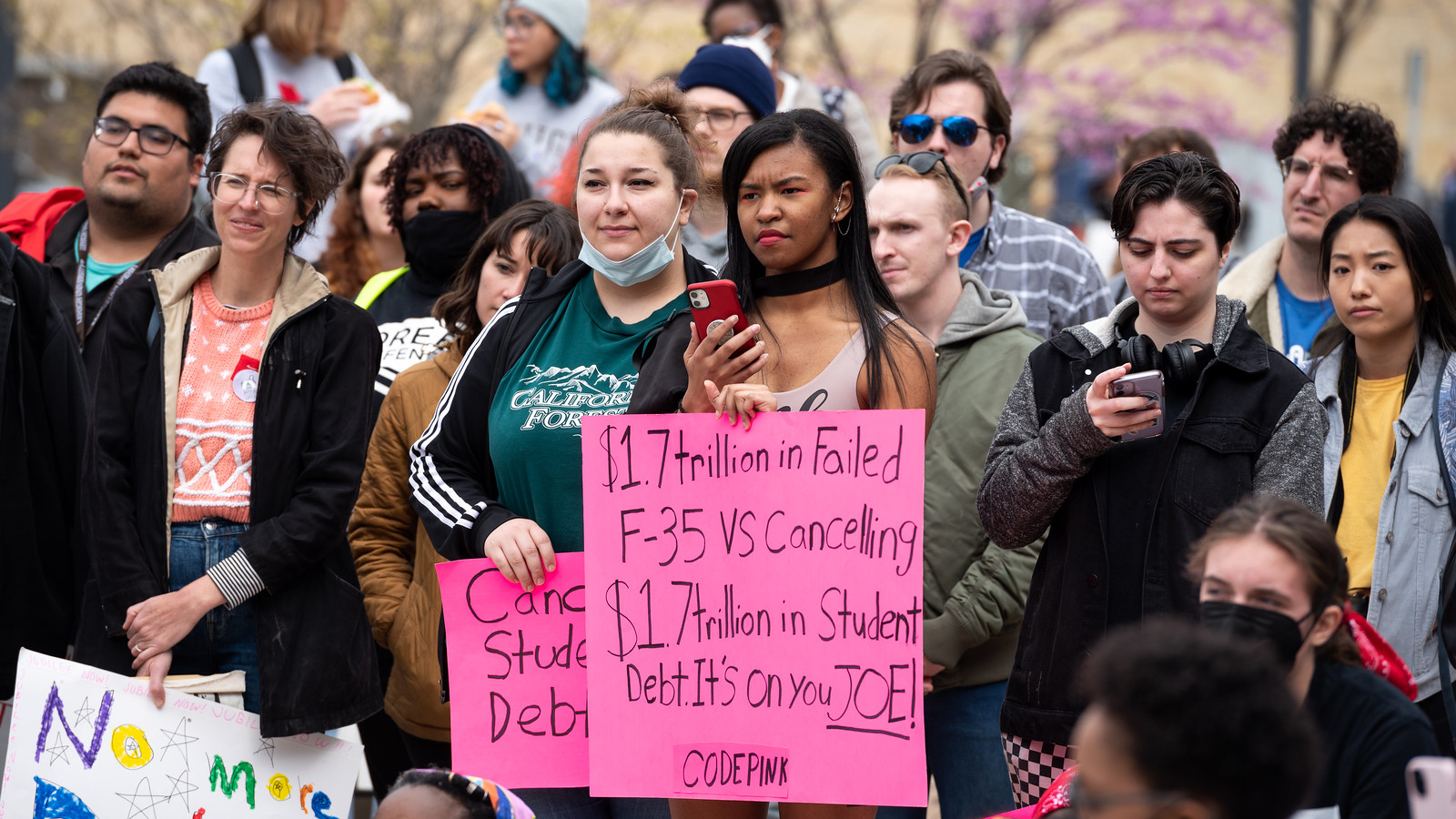

43.5 million people in the US have federal student loans, and they make up 92% of the USD 1.75 trillion collective student debt. Federal student loan payments have been paused since March 13, 2020, a result of the pandemic. For the past three years, poor and working people in the US have been hanging in limbo, unsure of when dreaded loan payments will resume, payments which almost four in ten borrowers are unable to afford. On August 24, Biden announced a loan forgiveness program that would have forgiven up to USD 20,000 for the most vulnerable of borrowers. The program was quickly halted by right-wing politicians before anyone could benefit, and the ultimate fate of this program is what will be decided by the Supreme Court in a few months.

Now, the fate of 43.5 million student loan borrowers is in the hands of the Supreme Court, an institution which in recent times has made several unpopular anti-people decisions.

What are the arguments against student loan forgiveness?

The Supreme Court heard two arguments against Biden’s student loan forgiveness program on Tuesday. Central to the cases are the arguments that Biden does not have the authority to use the 2003 HEROES Act, which allows the Secretary of Education to implement student loan relief in the case of national emergency (in this case, the pandemic) to implement student loan forgiveness. Instead, this decision should be left to Congress. A key argument is also that this program will be too costly.

Biden v. Nebraska was brought by six states controlled by the right-wing Republican Party, and hinges on the argument that the state of Missouri would be harmed by Biden’s program. MOHELA, the Missouri Higher Education Loan Authority, would lose revenue it earns from servicing debts, which would result in the state of Missouri losing money as MOHELA is obligated to make certain payments for capital projects for state universities. Except, MOHELA has neglected those payments for ten years, although it has contributed towards student aid programs. The Solicitor General of the United States, Elizabeth Prelogar, argued in favor of Biden’s program that there is no evidence that MOHELA will face any meaningful revenue decrease if Biden’s program goes through. MOHELA itself has been quiet about the case, and their absence was noted by several Supreme Court justices.

Some who organize around the issue of student debt argue that not only will debt forgiveness not harm MOHELA, it will more importantly benefit the people of Missouri “enormously”.

The second case is US Department of Education vs. Brown, which some say is a far weaker case even for the ultraconservative justices. Myra Brown, one of two plaintiffs in the suit, is arguing that she, as a private loan borrower, is harmed by Biden’s program, as it excludes her.

A seemingly strange argument on its face, however, in the US, the supposed exclusion of certain working people from student loan forgiveness is a common argument against it. This is especially true when it comes to those who did not attend college—a common right-wing argument being that student loans are only problems for the ‘elite’ university-educated, and not ‘salt-of-the-earth’ ‘blue-collar’ workers. Workers who did not attend school should not have their tax dollars go to the more privileged, as the argument goes.

In reality, the most marginalized of workers take on the most student loans: Black students leave college with USD 25,000 more in loans than white students, and carry the debt for longer. A Politico analysis found that 98% of applications for Biden’s student loan forgiveness came from zip codes with average yearly incomes under USD 75,000. Two thirds of applications came from zip codes with average yearly incomes under USD 40,000. The average income nationwide was USD 97,962 in 2021 (the median was USD 69,717).

Nonetheless, the narrative is pervasive. Conservative Chief Justice John Roberts set up a hypothetical on Tuesday during oral arguments: “You know, you have two situations. Both two kids come out of high school. They can’t afford college. One takes a loan, and the other says, ‘Well, I’m going to, you know, try my hand at setting up a lawn care service,’ and he takes out a bank loan for that. At the end of four years, we know statistically that the person with the college degree is going to do significantly financially better over the course of life than the person without. And then, along comes the government and tells that person, ‘You don’t have to pay your loan.’ Nobody’s telling the person who was trying to set up a lawn service business that he doesn’t have to pay his loan.”

Lawn care companies were one of many types of small businesses that had Paycheck Protection Program (PPP) loans forgiven after the height of the pandemic, as some have since pointed out. Myra Brown herself had her own PPP loan forgiven of about USD 48,000. As stated previously, Biden’s program would forgive only up to USD 20,000.

Brown is not alone—her case is in fact bankrolled by the innocuously-named Job Creator’s Network, whose multi-billionaire founder, Bernard Marcus, also founded the retail giant Home Depot. JCN’s top donors include the white nationalist Mercer Family, who backed the rise of Steve Bannon and Donald Trump and several other billionaires who have connections as far reaching as the Supreme Court justices themselves. The JCN itself had its PPP loan of around USD 135,000 forgiven by the US government.

The JCN argues that Biden’s loan forgiveness represents “government overreach” and “reckless government spending.” As A More Perfect Union reported, these donors benefited enormously from policies such as Trump’s 2017 tax cuts for the rich, which cost at least USD 1.5 trillion and therefore themselves benefit from “reckless government spending.” In comparison, Biden’s student loan program would cost around USD 400 billion for the next 30 years.